FICO Score

Sponsored ads:

The FICO score was first introduced in 1989 by FICO, then called Fair, Isaac, and Company.

The FICO model is used by the vast majority of banks and credit grantors, and is based on consumer credit files of the three national credit bureaus: Experian, Equifax, and TransUnion. Because a consumer’s credit file may contain different information at each of the bureaus, FICO scores can vary depending on which bureau provides the information to FICO to generate the score.

Makeup

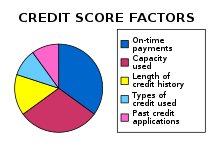

Credit scores are designed to measure the risk of default by taking into account various factors in a person’s financial history. Although the exact formulas for calculating credit scores are secret, FICO has disclosed the following components:

- 35%: payment history: This is best described as the presence or lack of derogatory information. Bankruptcy, liens, judgments, settlements, charge offs, repossessions, foreclosures, and late payments can cause a FICO score to drop.

- 30%: debt burden: This category considers a number of debt specific measurements, and not just the infamous credit card debt to limit ratio, as is commonly misreported. According to FICO there are some six different metrics in the debt category including the debt to limit ratio, number of accounts with balances, amount owed across different types of accounts, and the amount paid down on installment loans.

- 15%: length of credit history aka Time in File: As a credit history ages it can have a positive impact on its FICO score. There are two metrics in this category: the average age of the accounts on your report and the age of the oldest account.

- 10%: types of credit used (installment, revolving, consumer finance, mortgage): Consumers can benefit by having a history of managing different types of credit.

- 10%: recent searches for credit: hard credit inquiries, which occur when consumers apply for a credit card or loan (revolving or otherwise), can hurt scores, especially if done in great numbers. Individuals who are “rate shopping” for a mortgage, auto loan, or student loan over a short period (two weeks or 45 days, depending on the generation of FICO score used) will likely not experience a meaningful decrease in their scores as a result of these types of inquiries, as the FICO scoring model considers all of those types of hard inquiries that occur within 14 or 45 days of each other as only one. Further, mortgage, auto, and student loan inquiries do not count at all in your FICO score if they are less than 30 days old. While all credit inquiries are recorded and displayed on personal credit reports for two years they have no effect after the first year because FICO’s scoring system ignores them after 12 months. Credit inquiries that were made by the consumer (such as pulling a credit report for personal use), by an employer (for employee verification), or by companies initiating pre-screened offers of credit or insurance do not have any impact on a credit score: these are called “soft inquiries” or “soft pulls”, and do not appear on a credit report used by lenders, only on personal reports. Soft inquires are not considered by credit scoring systems.

Getting a higher credit limit can help your credit score. The higher the credit limit on the credit card, the lower the utilization ratio average for all of your credit card accounts. The utilization ratio is the amount owed divided by the amount extended by the creditor and the lower it is the better your FICO rating, in general. So if you have one credit card with a used balance of $500 and a limit of $1,000 as well as another with a used balance of $700 and $2,000 limit; the average ratio is 40 percent ($1,200 total used divided by $3,000 total limits). If the first credit card company raises the limit to $2,000; the ratio lowers to 30 percent; which could boost the FICO rating.

There are other special factors which can weigh on the FICO score.

Sponsored ads:

- Any money owed because of a court judgment, tax lien, etc., carries an additional negative penalty, especially when recent.

- Having one or more newly opened consumer finance credit accounts may also be a negative.

Ranges

There are several types of FICO credit score: classic or generic, bankcard, personal finance, mortgage, installment loan, auto loan, and NextGen score. The generic or classic FICO score is between 300 and 850, and 37% of people had between 750 and 850 in 2013. According to FICO, the median classic FICO score in 2006 was 723, and 711 in 2011. The U.S. median classic FICO score 8 was 713 in 2014.The FICO bankcard score and FICO auto score are between 250 and 900. The FICO mortgage score is between 300 and 850. Higher scores indicate lower credit risk.

Each individual actually has 65 credit scores for the FICO scoring model because each of three national credit bureaus, Equifax, Experian and TransUnion, has its own database. Data about an individual consumer can vary from bureau to bureau. FICO scores have different names at each of the different credit reporting agencies: Equifax (BEACON), TransUnion (FICO Risk Score, Classic) and Experian (Experian/FICO Risk Model). There are four active generations of FICO scores: 1998 (FICO 98), 2004 (FICO 04), 2008 (FICO 8), and 2014 (FICO 9). Consumers can buy their classic FICO Score 8 for Equifax, TransUnion, and Experian from the FICO website (myFICO), and they will get some free FICO scores in that moment ( FICO Mortgage Score 2 (2004), FICO Auto Score 8, FICO Auto Score 2 (2004), FICO Bankcard Score 8, FICO Bankcard 2 (2004) and FICO score 9. Consumers also can buy their classic FICO score for Equifax (version of 2004; named Score Power) in the website of this credit bureau, and their classic FICO Score 8 for Experian in its website. Other types of FICO scores cannot be obtained by individuals, only by lenders. Some credit cards offer a free FICO score several times per year to their cardholders.

NextGen Risk Score

The NextGen Score is a scoring model designed by the FICO company for assessing consumer credit risk. This score was introduced in 2001, and in 2003 the second generation of NextGen was released. In 2004, FICO research showed a 4.4% increase in the number of accounts above cutoff while simultaneously showing a decrease in the number of bad, charge-off and Bankrupt accounts when compared to FICO traditional. FICO NextGen score is between 150 and 950.

Each of the major credit agencies markets this score generated with their data differently:

- Experian: FICO Advanced Risk Score

- Equifax: Pinnacle

- TransUnion: FICO Risk Score NextGen ( formerly Precision )

Prior to the introduction of NextGen, their FICO scores were marketed under different names:

- Experian: FICO Risk Model

- Equifax: BEACON

- TransUnion: FICO Risk Score, Classic (formerly EMPIRICA)

Learn about Other Credit scoring models

Or… Learn about Free annual credit report

Sponsored ads: